Bitcoin halving

You’re our first priority.Every time.

Bitcoin has already seen a huge rally this year, gaining 47%. This was fueled first by the Securities and Exchange Commission approving exchange-traded funds that invest directly in bitcoin (rather than bitcoin futures) in early January. More recently, gains have been magnified as traders looked ahead to the halving, which will reduce the future supply of bitcoin in the market. Btc halving history Erika Rasure is globally-recognized as a leading consumer economics subject matter expert, researcher, and educator. She is a financial therapist and transformational coach, with a special interest in helping women learn how to invest.

Btc halving history

Because of the halving, Bitcoin miners aren’t able to sell as much Bitcoin as before to finance their operational costs. Fewer sellers means buyers have a larger impact, at least theoretically. Should you buy Bitcoin before the halving? June 2011, the first Bitcoin bubble: Although Bitcoin was born in 2008, it was not until 2011 that its price really began to soar. In early 2011, the trading price of Bitcoin was less than $1 per coin, but by June 2011, the price of each Bitcoin had risen to more than $31. However, due to the theft of 25,000 Bitcoins in a large-scale hacking incident at the Mt. Gox exchange, the price of Bitcoin fell to $2 by November 2011.

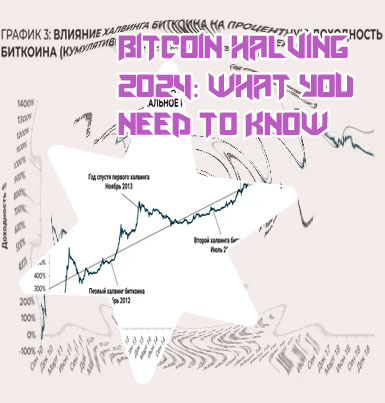

Is it true that bitcoin’s price goes up around a halving event?

At the time of the June 2016 halving, the price of Bitcoin was around $660; following the halving, Bitcoin continued to trade horizontally until the end of the month, before falling as low as $533 in August. But then Bitcoin’s price shot up to its then-all-time high of over $20,000 by the end of the year, an increase of 2,916%. Dividend Aristocrats Spotlight: Fastenal The Bitcoin halving is set to take place on April 8, 2024. Historically, the halving has sparked three shockingly similar adoption cycles. 9 months out, it’s time to start thinking about the next one.

Btc halving history

Let’s take a look at Bitcoin halving history. When the Bitcoin network first launched, miners earned 50 BTC per block, and the first Bitcoin halving in 2012 reduced the block reward to 25 BTC per block. From there, the 2016 halving event cut rewards to 12.5 BTC per block mined, and the BTC halving that took place in May of 2020 once again slashed this number down to only 6.25 new BTC per newly mined block. You are unable to access ccn.com However, Bitcoin's halving cycles typically follow a pattern of rally, correction, consolidation and eventual bull run post-halving. Despite significant price increases after each halving, there are consistent pullbacks, leading to broader market slowdowns.