How is bitcoin taxed

Contact Us Today

An example may crystalize the concepts outlined in the Notice above. Suppose that Adam mines Bitcoin and receives 6 Bitcoin tokens when the price per coin is $45,000. If we assume that Adam’s mining activities constitute a trade or business, or Adam receives the Bitcoin in his capacity as an independent contractor, the $270,000 ($45,000 x 6) worth of Bitcoin he receives will be treated as income taxed at ordinary tax rates. Additionally, under both circumstances, Adam will be subject to self-employment taxes and be required to remit estimated tax payments on a quarterly basis. If Adam performs mining as an employee, the $270,000 he receives will be subject to federal income tax withholding, with Adam receiving a Form W-2 every year. Do you have to pay taxes on crypto gains "If you make money on a cryptocurrency transaction and don't report the income, you could be in hot water," says Hayden Adams, CPA, CFP®, director of tax and financial planning at the Schwab Center for Financial Research.

Do you have to pay taxes on crypto gains

"Cryptos can be gifted in various forms, including gift cards, crypto tokens, or a crypto paper wallet. If the crypto is received as a gift from a relative, it is tax-exempt. However, if the value of the crypto gift from a non-relative surpasses Rs 50,000, it becomes taxable. Certain occasions, such as gifts received through inheritance, wills, marriage, or in contemplation of death, are exempt from taxes," says Gupta. Crypto Taxes: Reducing Your Tax Burden With Crypto Donations (2024) Even though Coinbase doesn’t supply this information through direct reporting to the IRS, you still must report this activity on your tax return as it is taxable income. You can access account information through the platform to calculate any applicable capital gains or losses and the resulting taxes you must pay on your tax return.

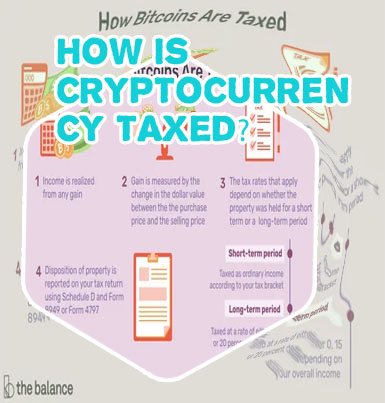

How are crypto treated for tax purposes?

When you hold Bitcoin, it is treated as property for tax purposes. As with stocks or bonds, any gain or loss from the sale or exchange of your Bitcoin assets is treated as a capital gain or loss for tax purposes. Long-term capital gains tax rates for 2023 Section 165 provides a deduction for losses that are evidenced by closed and completed transactions, fixed by identifiable events, and actually sustained during the taxable year. The IRS ruled that the cryptocurrency was not worthless because it was still being traded on a cryptocurrency exchange and the taxpayer made no affirmative act to abandon the cryptocurrency.

Do you have to pay taxes on crypto gains

We use cookies to improve your experience on our site. May we use marketing cookies to show you personalized ads? Manage all cookies Where can I find official IRS guidance on crypto? A28. When you receive cryptocurrency in exchange for property or services, and that cryptocurrency is not traded on any cryptocurrency exchange and does not have a published value, then the fair market value of the cryptocurrency received is equal to the fair market value of the property or services exchanged for the cryptocurrency when the transaction occurs.